Search

Recent comments

- larry johnson.......

4 min 16 sec ago - patriotism....

10 hours 7 min ago - belittling russia......

10 hours 34 min ago - Запад толкает Украину на последнюю битву....

10 hours 48 min ago - fourteen points....

10 hours 57 min ago - der philosophische glaube....

11 hours 8 min ago - seriously?...

11 hours 23 min ago - AfD....

11 hours 50 min ago - undesirables...

12 hours 6 min ago - assistant spies......

12 hours 32 min ago

Democracy Links

Member's Off-site Blogs

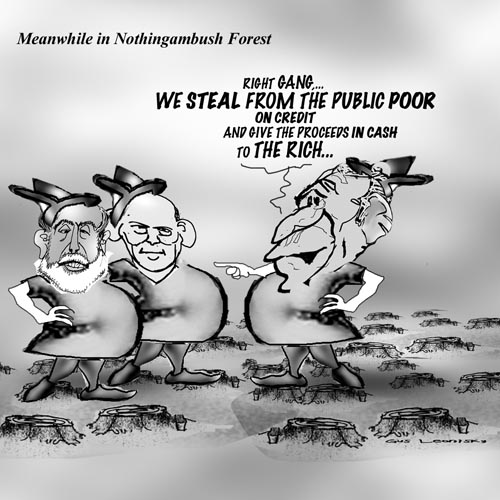

organised crime .....

Washington Mutual, the giant lender that came to symbolize the excesses of the mortgage boom, was seized by federal regulators on Thursday night, in what is by far the largest bank failure in American history.

Regulators simultaneously brokered an emergency sale of virtually all of Washington Mutual — the nation’s largest savings and loan, with $307 billion in assets — to JPMorgan Chase.

The move came as lawmakers reached a stalemate over the passage of a$700 billion bailout fund meant to help ailing banks, and removes one of America’s most troubled banks from the financial landscape while mitigating another potentially huge taxpayer bill for the rescue of another failing institution.

Shareholders and some bondholders will be wiped out. WaMu deposits are guaranteed by the Federal Deposit Insurance Corporation up to the $100,000 per account limit. Customers of Seattle-based WaMu are unlikely to be affected.

JPMorgan Chase — which acquired Bear Stearns only six months ago in another shotgun deal brokered by the government — is to take control Friday of all of WaMu’s 2,300 branches, which stretch from New York to California.

The New York-based bank will oversee its big portfolio of mortgage and credit card loans. It will also acquire all of WaMu’s deposits with the sale. Government Seizes WaMu & Sells Some Assets

meanwhile …..

Congressional leaders said more work was needed on President Bush's plan

US political leaders are continuing talks on a $700bn (£380bn) bail-out plan to revive the finance sector.

After several hours of talks with President George W Bush, members of congress said more work was needed.

Presidential candidate Barack Obama, present at the talks with his rival John McCain, said progress had been made on several key points.

Congressional leaders are to meet top government finance officials to try to rework the White House's proposal.- By Gus Leonisky at 26 Sep 2008 - 11:56pm

- Gus Leonisky's blog

- Login or register to post comments

sinking globally...

from Bob Ellis

The free market that never was..

Deregulation is wrong, it was always wrong, and it's now disabled America; discuss.

Clinton and Keating were wrong to support it; so were Bush and Howard, but they were always wrong about everything; discuss.

And so were Hayek and Milton Friedman: discuss.

Globalisation is at an end; discuss. Because a reregulated globalisation is a contradiction in terms. And I may get the Nobel Prize for economics for having seen it all coming. Maybe I won't.

For I wrote a book, you see, called First Abolish the Customer: 202 Arguments Against Economic Rationalism, which was read in libraries and other people's lavatories by about a hundred thousand Australians with nothing better to do. It was about how, if you sack too many people, or you underpay and impoverish too many people, there aren't enough customers left to sell things to, and the economy goes to hell. I wrote it in 1998 and nobody attacked any one of the arguments. They tiptoed away from the argument. They were above such things.

And lo, it has come to pass. Americans too impoverished to buy houses had stopped making their payments, and cash their creditors owed to lending entities further up the money chain could not be paid either, and like bird flu the illness swept across the planet, and here we are. And I was right; and Michael Costa and Peter Costello and all the neocons and Friedmanites and Tim Blair were wrong. And we are now in big trouble.

etc... read more of Bob and see toon at top.

losers, before being elected...

Amid the chaos and fear on Wall Street and around the world, with banks toppling like ninepins, two further losers beyond Fortis and Hypo have registered on guttering screens: Barack Obama and John McCain have both been rejected by their parties in Congress in favour of None of the Above. Both candidates supported the $700 billion bail-out that has just been battered to death on the floor of Congress by 228 votes to 205.

It is not unprecedented for a president of the United States eventually to lose the confidence of his party in Congress, as has now happened to George W Bush. What is unprecedented is for a presidential candidate to lose control of his party even before he has been elected, as has just happened to both Obama and McCain. Obama backed the bail-out, only to see 94 Democrat representatives tell him where to put it. McCain, more reluctantly, supported the proposal: 132 out of 199 Republicans told him to spin on it.

-------------------

read more at the Telegraph, see toon at top...

saving the rich...

'They're talking about credit and liquidity, but not ours'

In Riverside, California, the credit crunch is hitting home - and many people feel their problems are being ignored by the presidential candidates

Sitting on their back porch swing on a brilliant day last week, Sherrill Tinder and Bob Smith looked like a an ordinary middle-class couple, living a modest Southern California version of the American Dream here in Riverside.

see toon at top...