Search

Recent comments

- patriotism....

5 hours 57 min ago - belittling russia......

6 hours 24 min ago - Запад толкает Украину на последнюю битву....

6 hours 38 min ago - fourteen points....

6 hours 47 min ago - der philosophische glaube....

6 hours 58 min ago - seriously?...

7 hours 13 min ago - AfD....

7 hours 40 min ago - undesirables...

7 hours 56 min ago - assistant spies......

8 hours 21 min ago - brics.....

11 hours 29 min ago

Democracy Links

Member's Off-site Blogs

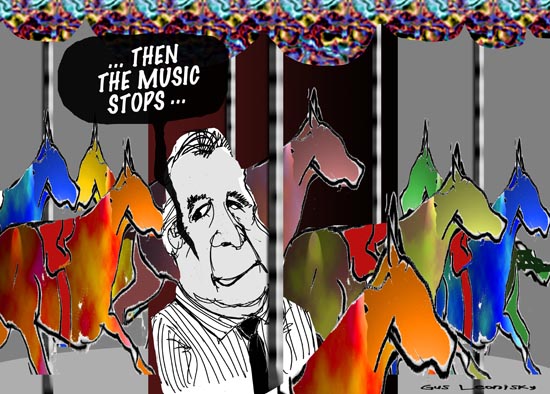

ride to nowhere .....

Watchdog 'ignored' Madoff warning

The top US financial regulatory body has ordered an in-house investigation into why it did not detect the $50bn (£33bn) Madoff fraud case sooner.The Securities and Exchange Commission (SEC) head, Christopher Cox, launched an inquiry into what he called a serious agency breakdown.

It has been revealed the SEC received warnings about Wall St figure Bernard Madoff almost 10 years ago, in 1999.Mr Madoff has been charged with fraud in one of the biggest-ever such cases.

Investors, banks and charities across the world fear they may have lost billions of dollars since Mr Madoff's arrest.It is thought that Mr Madoff was running what was essentially the world's largest pyramid scheme, the BBC's Andy Gallacher reports from Washington.

Now serious questions are being asked about the SEC's role in not preventing it in the first place, our correspondent says.- By Gus Leonisky at 18 Dec 2008 - 9:47pm

- Gus Leonisky's blog

- Login or register to post comments

on the merry-go-round

Firm Built on Madoff Ties Faces Tough Questions

By ALEX BERENSON and ERIC KONIGSBERGSince Bernard L. Madoff was arrested 11 days ago in connection with a $50 billion Ponzi scheme, the Fairfield Greenwich Group has portrayed itself as an unwitting victim of the fraud, the biggest of Mr. Madoff’s many losers.

Clients of Fairfield, a secretive hedge fund advisory company based in Connecticut, lost $7.3 billion to Mr. Madoff’s fund. But for Fairfield, working with Mr. Madoff was hugely profitable.

Internal documents from Fairfield show that the firm has taken more than $500 million in fees since 2003 alone from the money it placed with Mr. Madoff. Nearly all those fees went to a handful of Fairfield executives, including Walter M. Noel, Fairfield’s founder, who used the money to build a glamorous life, splitting his time between homes in New York, Connecticut, Florida and the Caribbean.

As it raised money all over the world, Fairfield also made detailed pledges about how it would monitor and track Mr. Madoff’s investments, the documents show. Now, investors and regulators are sure to ask whether Fairfield made good on those promises — or whether it was a facilitator of the Madoff scandal as well as a victim.

Similar questions may arise for the dozens of banks and hedge funds around the world that reaped extraordinary fees for steering investments to Mr. Madoff over the last decade. None of them, however, earned more from their Madoff business than Fairfield did during the firms’ 20-year relationship.

Fairfield promised its investors that money could not be moved from its accounts with Bernard L. Madoff Investment Securities without two signatures. It said that it would independently calculate the value of the funds it invested at Mr. Madoff’s firm at least once a week. It promised to reconcile statements from individual trades with Mr. Madoff’s custodial records.

It is not clear what Fairfield did to make good on those pledges.

A spokesman for Fairfield, Thomas Mulligan, offered only a statement characterizing the firm as a victim of Mr. Madoff.

see toon at top....

of chickens and foxes...

SEC 'chickens' humbled by Madoff whistleblower

By Stephen Foley in New York, The Independent

Thursday, 5 February 2009

The man who waged a decade-long crusade to unmask Bernard Madoff as a swindler was so frustrated at regulators' refusal to listen that he offered to go in disguise and undercover to help gather evidence.

Harry Markopolos, a Boston accountant who said it took him "five minutes" in 2000 to realise Mr Madoff's purported investment returns were impossible, appeared in public for the first time yesterday to eviscerate the Securities and Exchange Commission for its failure to uncover a $50bn (£34.6bn) Ponzi scheme – history's largest fraud.

Appearing before lawmakers on Capitol Hill, Mr Markopolos said most of the senior staff at the SEC should be sacked and the whole organisation rolled into a new super-regulator that employed more knowledgeable financial professionals and fewer lawyers.

"The SEC staff now is 3,500 chickens, and we need to get some foxes in there," he said. The organisation continues "to roar like a mouse and bite like a flea".

For the first time, the 52-year-old Mr Markopolos told the story of how he and a small team of helpers investigated Mr Madoff by gathering evidence from market participants, rivals and more than a dozen hedge funds – many of them in Europe – that were funnelling money to the alleged fraudster.

The quartet included two former colleagues from his old firm, Rampart Investment Management, and a trade magazine journalist whose 2001 piece raising scepticism about Mr Madoff had been brushed off by the financier. The team fell back on intelligence-gathering techniques that Mr Markopolos said he used as a special operations major in the army reserves.

"Each of us feared for our lives," Mr Markopolos said. "If he'd have known my name and known he had a team tracking him, I didn't think I was long for this world."

see toon at top...

crooked bat...

Texan billionaire and cricket promoter Sir Allen Stanford has been charged over a $8bn (£5.6bn) investment fraud, US financial regulators say.

The Securities and Exchange Commission said the financier had orchestrated "a fraudulent, multi-billion dollar investment scheme".

The SEC said the fraud was "based on false promises and fabricated historical return data".

English cricket bosses have pulled out of sponsorship talks with Sir Allen.

The charges against Sir Allen, three of his companies and two executives of those companies followed a raid by US marshals on the Houston, Texas, offices of Stanford Financial Group.

-----------

see toon at top....

Smash-me Bernie doll

An Australian toy designer has created a surprise hit with a doll of the US financier, Bernard Madoff, who is accused of a $50bn (£35bn) fraud.

The Smash-Me Bernie figurine wears a devil's red suit, carries a pitchfork and comes with a golden hammer for smashing the doll into pieces.

Creator Graeme Warring said he came up with the idea after a friend of his lost money in the scandal.

Mr Madoff's former clients may not feel like meeting the $100 price tag.

Smash-me Bernie attracted worldwide media interest when it went on display at the New York Toy Fair this week, says the doll's creator.

-------------------

see toon at top...