Search

Recent comments

- patriotism....

9 hours 10 min ago - belittling russia......

9 hours 38 min ago - Запад толкает Украину на последнюю битву....

9 hours 52 min ago - fourteen points....

10 hours 1 min ago - der philosophische glaube....

10 hours 12 min ago - seriously?...

10 hours 26 min ago - AfD....

10 hours 54 min ago - undesirables...

11 hours 10 min ago - assistant spies......

11 hours 35 min ago - brics.....

14 hours 43 min ago

Democracy Links

Member's Off-site Blogs

most important dollar sludge...

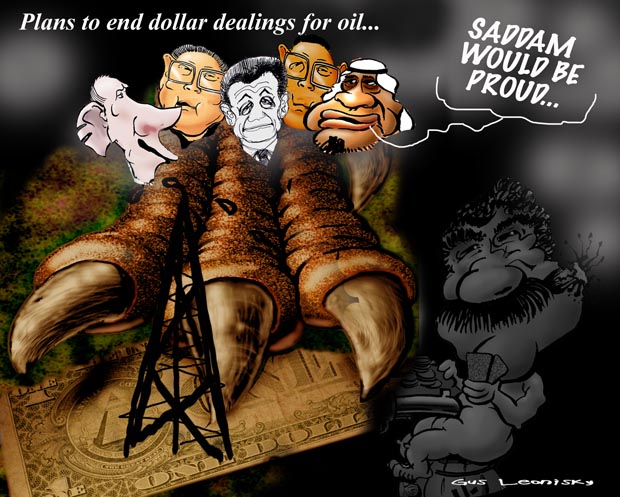

In the most profound financial change in recent Middle East history, Gulf Arabs are planning – along with China, Russia, Japan and France – to end dollar dealings for oil, moving instead to a basket of currencies including the Japanese yen and Chinese yuan, the euro, gold and a new, unified currency planned for nations in the Gulf Co-operation Council, including Saudi Arabia, Abu Dhabi, Kuwait and Qatar.

Secret meetings have already been held by finance ministers and central bank governors in Russia, China, Japan and Brazil to work on the scheme, which will mean that oil will no longer be priced in dollars.

- By Gus Leonisky at 6 Oct 2009 - 6:03pm

- Gus Leonisky's blog

- Login or register to post comments

one has to remember...

Once upon a time, there live a Swine, called Saddam. in the hot deserts of Iraq who decided to trade his eggs in Eurobux... This got up the nose of "sneaky" Yamerica Fairy who decided to be "badder" and eliminate Saddam, to take over his golden goose, in whichever way she could... So feathers flew as Yamerica's bombs landed on a restaurant where Saddam Swine was not. Since then, more than one million poor souls died, 4.5 million souls lost their space and trouble brew forever after...

black gold and gold...

The price of gold has hit a new all-time high of $1,043.77 an ounce after a decline in the dollar boosted the attractiveness of metals to investors.

Copper prices also rose above $6,000 a tonne, as the weaker dollar made metals cheaper for non-US investors.

The dollar fell after a newspaper report - later denied - said that Gulf nations wished to replace the greenback as the main oil currency.

The rise in metal prices lifted shares in mining firms.

Mining stocks were among the biggest risers on the UK's main FTSE 100 share index, with Fresnillo adding 10% and both Kazakhmys and Vedanta up 9%.

------------

see toon above...

t'was all 'bout oil...

It does not look like much: a jumble of pipes, containers and drilling equipment sitting on a windswept jetty at Port Stanley.

The hardware, however, signals an imminent search for oil and gas that could turn the Falkland Islanders into south Atlantic oil barons, a prospect that has already triggered a dispute between Britain and Argentina.

A rig, the Ocean Guardian, is due to arrive by mid-February and will almost immediately begin drilling for hydrocarbon deposits 100 miles north of the archipelago.

Geological surveys suggest there could be up to 60bn barrels beneath the seabed around the British territory, a bonanza that would transform islands famed for sheep, fish and remoteness.

"The rig won't come into sight of Port Stanley unfortunately, it'll be out too far," said Phyll Rendell, the islands' director of mineral resources. "But everyone knows it's coming."

--------------------

gold, gold, gold...

A stampede of the super-rich is underway as they snap up gold to secure their wealth as the economies of the world wobble.

"The most we've sold in the last couple of weeks for a customer's own vault was $5 million [in bullion], about 100 kilograms," says Janie Simpson of the Australian Bullion Company.

The number of transactions have stepped up in recent months, she says.

"It just keeps getting bigger and bigger. We had to put on a new staff number this month to cope with the volume.

"Three years ago, if you said you held physical gold in your investment portfolio, people might think it's almost a bit strange.

"But now, people are holding physical precious metals in their portfolio. It's mainstream."

http://www.smh.com.au/executive-style/going-for-gold-how-a-strange-investment-is-now-mainstream-20101007-1690v.html

------------------------------

My last year prediction of the price of gold going through the roof is coming to realisation... This info did not come from "my portfolio" (of debts) but from a gold investor who saw some crazy derivative bets made in gold!... Apparently these bets were not even covered by the actual total amount of gold on the planet.