Search

Recent comments

- breeding insanity....

8 hours 3 min ago - american "diplomacy"

10 hours 59 min ago - deceit america....

13 hours 18 min ago - police-state....

22 hours 58 min ago - the war continues....

23 hours 47 min ago - scott is angry.....

1 day 6 hours ago - a catastrophe?....

1 day 10 hours ago - 3Xwars is 3Xpeace?....

1 day 12 hours ago - futile trousers....

1 day 12 hours ago - reading reality....

1 day 13 hours ago

Democracy Links

Member's Off-site Blogs

fiction in history...

- By Gus Leonisky at 21 Apr 2010 - 3:46pm

- Gus Leonisky's blog

- Login or register to post comments

more fiction in history

aaaaaha-hahahhhha....

still laughing...

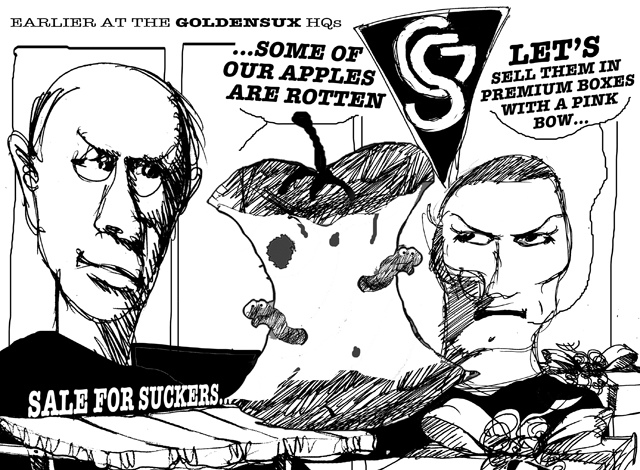

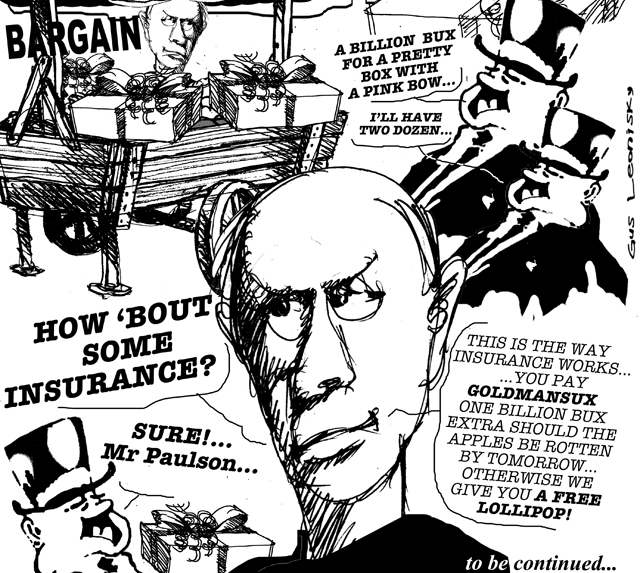

paulson bullshit...

The “Tea Party” designation refers to a diverse lot, and Weisberg is exaggerating its anti-establishment features. Some Tea Partiers speak of “taking our country back” while looking forward to pulling the lever for Mitt Romney in 2012, or think Sarah Palin, a complete nonentity, is a “maverick” despite being in Bill Kristol’s hip pocket. This branch of the Tea Party poses no threat to any established interest, and in fact strengthens the regime by misdirecting justifiable anger into officially approved channels.

But there is a sliver of genuine rebelliousness to be found here and there in the Tea Party, and it is this that Weisberg finds so awful and scary. “What’s new and most distinctive about the Tea Party,” he writes, “is its streak of anarchism – its antagonism toward any authority, its belligerent style of self-expression, and its lack of any coherent program or alternative to the policies it condemns.” Perhaps worst of all, Weisberg huffs, the peons don’t trust the experts, a designation they insist on preceding with the adjective “so-called”!

They don’t trust the experts? I can’t imagine why. Could it be that the experts told us the economy was fine in 2006? (James Galbraith admits this: only about a dozen economists predicted the financial crisis, according to him, though – natch – he pretends the Austrian economists do not exist.) Or maybe it’s because economist Paul Krugman said in 2001 that what the economy needed was low interest rates to spur housing – the very thing that gave rise to the housing bubble. Or maybe because Ben Bernanke denied there was a housing bubble, said lending standards were sound, denied that the subprime problem would spill over into the rest of the economy – there’s no real need to go on, since one of those uppity anarchists has collected these and other whoppers into one of those authority-undermining YouTubes that are destroying America.

I can’t resist one more example: Just two months before Fannie and Freddie collapsed and were taken over by the government, then-Treasury Secretary Hank Paulson told reporters not to worry: after all, he said, their regulator reported that they are adequately capitalized. When called on this two months later, Paulson denied having misled anyone: “I never said the company was well-capitalized. What I said is the regulator said they are adequately capitalized.”

See, Jake, people don’t trust someone like that.

http://www.amconmag.com/blog/tea-and-anarchy/

-----------------------

Gus: see all the toons above from top down... And please tell all your friends and your enemies about this site. Our readership is increasing reasonably but it would be great to spike and stay spiked... more than 50,000 pages are read each month but we should aim for 500,000 or more, say 5,000,000. And beat Mr Murdoch.

Providing original toons with reasonable caricatures takes time (about 15 seconds on average per head), though I recycle a lot... I create different toons using a bank of bits. Forgive me but I'm lazy... If you are readers from a country other than Australia (which is a bit more than half the average readership) you can still push the buttons of this country and your own. And we still don't know who you are. But you deserve our thanks for your bravery. Ciao. Gus..

charged in connection with the global financial crisis...

REYKJAVIK, Iceland — Iceland's former Prime Minister Geir Haarde has been referred to a special court in a move that could make him the first world leader to be charged in connection with the global financial crisis.

After a heated debate Tuesday, lawmakers voted 33-30 to refer charges to the court against Haarde for allegedly failing to prevent Iceland's 2008 financial crash – a crisis that sparked protests, toppled the government and brought the economy to a standstill by collapsing its currency.

Haarde faces up to two years in jail if found guilty. The court, which could dismiss the charges, has never before convened in Iceland's history. A hearing date has not yet been set.

http://www.huffingtonpost.com/2010/09/28/geir-haarde-indicted-iceland-financial-crisis_n_742800.html

Bush does a stand-up comic routine...

And in his own words, George W Bush wrote:

"I turned to the Rough Rider of my financial team, Secretary of the Treasury, Hank Paulson... 'The situation is extraordinarily serious, Hank said. He and his team briefed me on three measures to stem the crisis... 'These are dramatic steps', Hank said, 'but America's financial system is at stake'... 'Get to work,' I said, approving Hanks's plan in full. 'We are going to solve this."

------------------

Gus: Paulson was part of the problem and he was given the "power" to solve the crisis by the idiot president? Has the crisis been solved yet? Nupe... Bush's thought process is (was) totally lacking in understanding. There is hardly any complexity where cause and effect are analysed properly ... just a pass-the-buck "decideration" that would befit a kindergarten toddler deciding to poo in his pants because it gives more playing time otherwise spent on the potty...

see all the toons in this line of comments...

did not confirm...

Amid the economic crisis a handful of too-big-to-fail US banks have come under scrutiny for their dealings, particularly with mortgaged-backed securities that helped fuel the meltdown.

Executives from Goldman Sachs and the now-defunct Lehman Brothers and Bear Stearns have been hauled before the US Congress to explain their banks' actions.

Mr Assange mentioned Goldman Sachs by name in the interview, but did not confirm the Wall Street giant will be the target of the leak.

Goldman recently agreed to a $US550 million settlement with the Securities and Exchange Commission to settle fraud charges.

Facing allegations of defrauding investors, the storied investment bank admitted it had made a "mistake" and given "incomplete" information to clients.

Mr Assange said "about 50 per cent" of the documents WikiLeaks holds relate to the corporate world.

http://www.abc.net.au/news/stories/2010/11/30/3080435.htm

see toon at top...

economic warfare...

We already know that it’s party time for the financial elite who gave real meaning to the phrase “economic meltdown” in 2008, that bonuses are soaring, that corporate profits for the third quarter of 2010 are beyond the stratosphere, and that the corporate chieftains and Wall Street titans of our new gilded age have, as New York Times columnist Bob Herbert wrote recently, “waged economic warfare against everybody else and are winning big time.”

What we know far less about is the degree of the catastrophe they inflicted on the rest of us. Here’s just one story that should be front-paged in our major newspapers, but for which, at the moment, you have to turn to Dollars and Sense, a modest if intriguing economic publication. There, Jim Campen, professor emeritus of economics at the University of Massachusetts-Boston and an expert on racial discrimination in mortgage lending, has written a piece entitled, “Update on Mortgage Lending Discrimination: After a Disastrous Detour, We’re Back Where We Started.”

It may not sound like much, but what a horror story it tells. If you were black or Latino in the 1980s or early 1990s and wanted to buy a home, the odds were that the banks had “redlined” your neighborhood and were denying you mortgage applications at “disproportionately high rates” compared to whites in similar economic circumstances. In other words, you would have a tough time becoming a homeowner. Then came those high-cost subprime loans whose fine print ensured that you would never be able to pay them back. In a case of “reverse redlining,” they were aggressively targeted at black and Latino neighborhoods in numbers strikingly disproportionate to white neighborhoods. Not surprisingly, when the housing bubble burst, the financial world shuddered, the economy went south, and wave after wave of foreclosures began to sweep across the country, it was black and Latino homeowners suffered the most.

In Boston in 2006, the peak year of the subprime lending boom, Campen discovered that “49% of all home-purchase loans to blacks, and 48% of all home-purchase loans to Latinos, were high-cost loans, compared to just 11% of all loans to whites.” In the carnage that followed, he informs us, nearly 8% of black and Latino homeowners were foreclosed on, compared to 4.5% of whites. In other words, while the people TomDispatch Associate Editor Andy Kroll calls “the New Oligarchs” bought Dom Pérignon and celebrated, they had let loose the financial equivalent of a neutron bomb on nonwhite neighborhoods in America. It’s a scandal that should be at the top of the news, not in obscure magazines or at websites like this one, and it’s just a small part of the larger, distinctly un-American scandal that Kroll lays out below. Tom

The New American Oligarchy

read more at http://www.tomdispatch.com/Creating a Country of the Rich, by the Rich, and for the Rich

By Andy Kroll

see all the toons from top down...

accounting fraud...

Accountancy giant Ernst & Young has been sued by New York's attorney general over its role in the collapse of Lehman Brothers during the financial crisis in 2008.

Andrew Cuomo claimed the firm was complicit in a "massive accounting fraud" perpetrated by Lehman.

Ernst & Young said that it would "vigorously defend" itself.

"There is no factual or legal basis for a claim to be brought against an auditor in this context," it said.

"Lehman's audited financial statements clearly portrayed Lehman as a highly leveraged entity operating in a risky and volatile industry."

Settlement

Mr Cuomo takes a different view.

"At a time when it was critical for investors to make informed decisions as to whether to keep or to buy Lehman, Ernst & Young assisted Lehman in defrauding the public," the lawsuit clams.

-----------------------

http://www.bbc.co.uk/news/business-12057170

see toons at top

the greenspan/paulson fun fair...

The crisis has not crept up on us completely unawares. A procession of

Cassandras have tried to warn us (or at least the U.S. Congress): James Bothwell in

1994; Brooksley Born in 1998 and 1999; Warren Buffett in 2007, 2008 and 2009; Ed

Gramlich in 2004; Timothy Geithner in 2004; Ben Bernanke in 2005 and 2007; Richard

Hillman in 2007; John Taylor in 2007; Meredith Whitney in 2007; C.K. Lee in 2008;

George Soros in 2008; and, Paul Volker in 2009.

But these brave men and women had little, if any, impact. Arrayed against them

were the optimists, most significantly Alan Greenspan, Robert Rubin, Arthur Levitt Jr.,

Hank Paulson, Joe Cassano and Dick Fuld.

After the crash had arrived, it is true, Alan Greenspan did admit “partial”

responsibility and later he allowed that temporary bank nationalization might be

appropriate once every century. Ben Bernanke has also spoken of the lack of regulation

of AIG’s financial activities, with today’s consequences. Others have been mute.

In Weisberg’s words (2010): There are no strong candidates for what logicians

call a sufficient condition—a single factor that would have caused the crisis in the

absence of any others. There are, however, a number of plausible necessary conditions—

factors without which the crisis would not have occurred.

On reflection, I believe the crisis was brought on mainly by three actions in the

U.S., which occurred on November 12, 1999, December 21, 2000, and July 21, 2004:

repeal of the Glass-Steagall Act, the explicit decision not to regulate derivatives, and

allowing the Wall Street banks to expand their leverage threefold or more. These were

failures of regulation, not acts of venality. Another way of looking at what happened is

that, like the Prisoner’s Dilemma or the Tragedy of the Commons, it was a phenomenon

where individually rational actions were collectively irrational: no investment bank

could afford not to trade in credit default swaps, since others would do so at the first

bank’s competitive expense, but the eventual aggregate outcome was the credit crisis.

Such phenomena require effective regulation, which failed here, over a period of years.

http://www.agsm.edu.au/bobm/iows/timeline.pdf