Search

Recent comments

- google bias...

11 hours 6 min ago - other games....

11 hours 9 min ago - נקמה (revenge)....

12 hours 9 min ago - "the west won!"....

14 hours 12 min ago - wagenknecht......

14 hours 53 min ago - the game of war....

17 hours 18 min ago - three packages....

18 hours 38 min ago - russian oil.....

18 hours 45 min ago - crime against peace....

1 day 2 hours ago - why is Germany supporting the ukrainian nazis?....

1 day 4 hours ago

Democracy Links

Member's Off-site Blogs

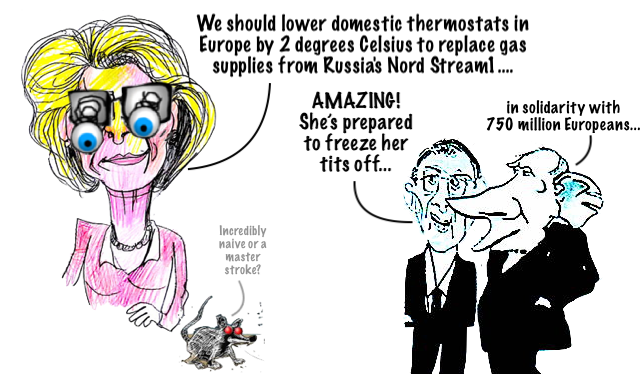

switching the thermostats off or buying russian bear skins to keep warm?…..

BRUSSELS (Sputnik) - The proposal voiced by European Commission President Ursula von der Leyen to lower domestic thermostats in Europe by 2 degrees Celsius to replace gas supplies from Russia's Nord Stream 1 is "incredibly naive," energy experts said on Tuesday.

On Monday, the EC head said that Europeans can replace gas supplies coming via Russia's Nord Stream 1 pipeline by lowering the heating or air conditioner temperatures by 2 degrees, adding that the EU has comprehensive emergency plans in place, including energy savings.

Samuele Furfari, a professor of geopolitics of energy at ULB university in Brussels, believes that von der Leyen's proposal is "ridiculous," as a two-degree reduction in heating cannot replace energy demand of 194 million European households.

"It is incredibly naive of the President of the European Commission to present a 2-degree reduction in domestic heating, for more than 194 million households in the Europe at 27 [countries], as a solution to the end of the supply of Russian gas by Nord Stream 1. It is moreover only the capacity of Nord Stream 1 which would be 'covered' by this theoretical and simplistic reduction. There are other gas pipelines delivering Russian gas. She even specifies, since the commission seems to have thought about this ridiculous idea, that it would also apply to air conditioning. We navigate in a pure dream,” Furfari said.

Gas demand is inelastic, so Europe cannot lower the heating in hospitals or schools, and it is "a dream" to believe that EU residents will simply comply with von der Leyen's proposal, which will "hit people hard" in their comfort zone, he added.

“How are we going to apply this theoretical measure seriously? By installing 'limited' room thermostats, such as for car or motorcycle engines? Are we being prepared for Orwell's society? No EU government is going to accept that Brussels gives them temperature reduction instructions or face sanctions. I am not even talking about the electricity market, which does not work in Europe, with the emphasis wrongly put on pseudo-renewable energies. Obviously, the European Commission is totally stuck, and Brussels does not know what to do. There is no other solution than that of Russian gas supplies for a long time to come. We are waiting for the next 'brilliant' idea from the European Commission,” Furfari said.

According to the professor, 70% of the gas consumed in Europe is allocated to the production of heat, and even when Germany relaunches its coal power stations, which emit large amounts of CO2, it will be far too little to compensate for the loss of gas.

Damien Ernst, a Liege university professor in Belgium and a specialist of electromechanical engineering and energy, said that von der Leyen's proposal shows how much the EU is "at a loss."

“Europe will suffer terribly in terms of energy prices and scarcity. This astonishing reaction from Ursula von der Leyen is even scary, as she is so naive, and shows how much the EU is at a loss. The EU is not going to send armies of controllers to check the ambient temperature in people's homes. At best, Europe can only carry out awareness campaigns on the need to save energy,” Ernst said.

If there is a signal that the price will become "astronomically high," people and businesses will spontaneously reduce their consumption, causing a sharp decrease in demand and reducing the competitiveness of European producers compared to those from Asia and the US, Ernst explained.

“Europe has it all wrong,” he lamented.

READ MORE:

FREE JULIAN ASSANGE...........

- By Gus Leonisky at 22 Jun 2022 - 10:15am

- Gus Leonisky's blog

- Login or register to post comments

no more cheap gas…….

By Daoud BaalbakiJune 15 2022

Europe’s dependency on Russian natural gas has been a contentious issue for European Union (EU) policy makers for decades. Dozens of policies have been proposed over the years to diversify the continent’s gas supply, or to switch to green energy sources in order to minimize reliance on Russian gas.

There are only two ways to transport natural gas – via pipelines, or by liquifying the gas, transporting it as cargo, then re-gasifying it at the destination. Both processes require time and considerable infrastructure investment.

Pipelines: In 2021, Russian natural gas accounted for about 46 percent of the EU’s total natural gas imports with an amount of 155 bcm (billion cubic meters). Figure 1 shows that Russian pipelines provided about 41 percent (about 139 bcm) of these gas imports to the EU over the same period.

Norway is Europe’s second-biggest natural gas supplier, followed by pipelines from North Africa and Azerbaijan.

LNG: Imports of LNG constitute about 21 percent of total European natural gas imports.

Figure 2 shows the sources for the LNG shipments that were imported by the EU in 2021. It is important to note that the United States represents the main supplier for LNG to the EU, and is likely to be the main beneficiary if Russian gas pipelines cease operations. The US only commenced exports of LNG to the EU in 2016, but rapidly reached 22.3 bcm in 2021, representing 23 percent of all LNG exports from the US.

Europe’s dependency

Before the conflict in Ukraine, Russia was still a major supplier for LNG in Europe with about 20 percent of the total LNG imports (equivalent to 16 bcm). This means the EU imported a total of 155 bcm of natural gas from Russia annually – 139 bcm via pipelines and 16 via LNG. This accounts for almost half of all European natural gas imports.

This strategic failure in achieving independence from Russian natural gas was mainly due to lack of a coherent and unified strategy among EU members. As shown in Figure 3 the dependency on Russian natural gas varies from one European country to another.

Countries like the Czech Republic, Slovakia, Latvia, Estonia, Finland, and Hungary are fully dependent on Russian natural gas, while the countries that import the largest quantities like Germany, France, Italy Poland, and Greece are semi-dependent, and countries like Portugal are quasi-independent.

With intense pressure from Washington, this issue of over-reliance on Russian resources became further securitized following the conflict in Ukraine. Even after the west announced sanctions on Russian imports, the EU imported 39 billion euros worth of fossil fuel from Russia, until as recently as mid-May.

Reducing reliance on Russia

According to a Flash Eurobarometer survey for the European Commission (EC), 85 percent of Europeans believe that the EU should reduce its dependence on Russian gas and oil as soon as possible to support Ukraine. Meanwhile the EC, international agencies, and independent think tanks have proposed short term plans to decrease the EU’s dependence on Russian fossil fuels by the end of 2022.

The main three short term plans are the EC’s REPowerEU Plan under which two-thirds of Russian gas (101.5bcm/155bcm) could be replaced by next winter; the International Energy Agency’s (IEA) ten-point plan which proposes a one-third (50bcm / 155bcm) reduction of the Russian natural gas imports, finding alternative sources, and switching to renewable energy; and economic think tank Bruegel’s plan which says, in theory, the EU should be able “to replace Russian [gas] flows entirely,” even in the short term, by calculating Europe’s spare gas import capacity. Realistically, however, Bruegel calls for a reduction (86 bcm/155 bcm) by possibly switching electricity production to nuclear and coal, while applying energy saving policies.

What’s the plan?

Essentially, what these plans all have in common is a call for the EU to diversify its natural gas imports portfolio, switch to renewable energy, and apply policies for energy saving. Of the aforementioned plans, the REPowerEU strategy appears to be the most feasible.

The plan suggests cutting Russian natural gas imports to 101.5 bcm from 155 bcm in 2021 – in theory, by increasing non-Russian gas supply by 63.5 bcm, and reducing gas demand by 38 bcm.

To increase non-Russian gas supply by 63.5 bcm, the plan assumes the following can be achieved:

Complimentary to this, they also recommended reducing gas demand by 38 bcm. For this, they proposed 4 points:

The first problem with the EC study is that it expects the demand for gas in Europe in 2022 to remain the same as in 2021. Studies shows that the continent may need around 20-25 bcm more than in the same period last year. So, the target gas requirement is actually 121.5 – 126.5 bcm – not just replacing the Russian imports of 101.5 bcm.

Increasing non-Russian LNG

By far the most important metric here is the EU’s current regasification capacity. As mentioned above, when imported as LNG, the liquified gas needs to be regasified by specialized plants in ports in order to be reinjected into pipelines. All combined, the EU countries had around 74 bcm spare regasification capacity last year.

The problem is that about half this spare capacity is concentrated in Spain and Portugal, which are linked to the rest of the EU with a pipeline of just 7.5 bcm/year capacity. Therefore, the EU has insufficient re-gasification plants to import an additional 50 bcm of LNG.

The proposed solution is to use the UK (now, officially outside the EU) – which has around 29 bcm spare regasification capacity – as a land bridge to import LNG and then reexport it to the EU via pipelines. In this scenario, the EU may succeed in importing an extra 50 bcm of LNG.

But even if Europe overcomes the regasification obstacle, is there enough LNG supply in the world to cover the demand?

Switching dependency from Russia to the US

Due to many export plants struggling with technical and feed gas issues during the year, global LNG export capacity actually declined in 2021, despite the continued rise in capacity in the US. At the beginning of 2022, it was estimated that the LNG global export capacity will increase by some 43 bcm if all plants that had technical issues and shutdowns were to come back online.

In the second quarter of this year, the International Energy Agency’s gas market report estimated that the EU’s LNG imports may increase by a maximum of 25 bcm and that 65 percent of this quantity will be supplied by the US.

If this transpires, US LNG exports will increase by a whopping 19 percent, making it the global leader of LNG exports overnight. Meanwhile, Africa, Europe, Central and South America and Eurasia will have smaller contributions to global LNG supply growth in 2022, while the supply of the Asia Pacific and West Asian regions are expected to decline.

If we take Qatar as an example, despite its leading role in LNG markets and close relations with western states, Qatar is unable to supply Europe with extra large quantities in the short term because it suffers from a lack of spare LNG export capacity. Furthermore, over 70 percent of these exports are sold to Asian buyers via long term contracts. Europe would have to wait until 2024-25 to be able to count on Qatari LNG supplies.

This high-level demand for LNG projected by Europe will saturate the market and increase the competition for flexible LNG cargoes. In order to attract more LNG cargoes, spot prices in Europe should be $2-3/MMBtu higher than the Asian markets. This is leveling now at $35/MMbtu for the rest of 2022 which is more than five times their five-year average.

The bottom line is that it will be impossible for the EU to increase their LNG imports by the crucial 50 bcm milestone. Even if the EU overcomes the technical issues represented by the regasification capacities and the interconnections between the EU countries and Britain, the supply in the global LNG market simply cannot meet the demand.

Although Europe may receive an extra 25 bcm of LNG, it will come attached to a very high price tag, while prices in North America will be largely unaffected. The US is the big winner in this scenario, raking in exorbitant profits while establishing itself as the world’s biggest LNG exporter.

Where are the non-Russian gas pipelines?

Norway: As the main non-Russian gas supplier of natural gas to Europe via pipelines, Norway’s total capacity of supply is 94.3 bcm per year. Only 86.3 percent of this capacity was used in 2021, theoretically leaving 12.9 bcm of spare annual capacity.

However, in the first two quarters of 2022, the pipelines have been working close to effective full capacity, and this capacity is expected to be lower in the summer, as previous records indicate.

North Africa: The other source of pipeline natural gas to Europe is via three pipelines from North Africa: The Medgaz pipeline from Algeria to Spain, the Trans-Mediterranean Pipeline (also known as Transmed which carries Algerian gas from Tunisia to Italy), and the Green Stream pipeline, from Libya to Italy. A fourth pipeline, the Gas Pipeline Maghreb-Europe (GME), runs from Algeria to Spain via Morocco, but has not been used since 1 November 2021, following the breakdown of diplomatic relations between Algeria and Morocco that August.

The flow in Medgaz pipeline to Spain can increase by around 2 bcm, after increasing its capacity. These extra quantities can cover a part of the quantities that have been delivered via GME in 2021. However, Algeria has also recently suspended trade ties with Spain over the latter’s decision to side with Morocco over the disputed Western Sahara territory, which has exacerbated tensions between Rabat and Algiers.

The Transmed pipeline to Italy has around 10 bcm spare capacity, but recent analysis shows that Algeria will not be able to offer additional gas quantities since reaching its production capacity and needing to address its own growing domestic demand.

Exports in Libya ranged around 5 bcm before 2020 but declined to 3.2bcm in 2021. A recovery can offer the extra 1-2 bcm, but ongoing political instability in Libya can offer no such guarantees.

As a result, North Africa is not foreseen to provide any extra-large quantities of gas to Europe in 2022.

Azerbaijan: In 2021, the EU started receiving natural gas from Azerbaijan via the Trans Adriatic Pipeline (TAP). The capacity of TAP is around 11 bcm, and flows in 2021 totaled 8.1 bcm, meaning there is extra capacity of around 2.5 bcm.

Overall, the EU plan is based on making a year-on-year increase of 2-3 bcm from Azerbaijan, 2-3 from Algeria, and 4-5 bcm from Norway. These appear to be achievable with regards to the pipelines’ spare capacities, but ambitious in terms of gas production quantities for the suppliers.

Trading dependencies

This European demand for non-Russian gas will mainly be covered by the United States which is the only player that stands to gain economically. It is therefore in Washington’s interests that Europe converts a big part of its gas imports from Russian pipelines into LNG. It is also why the US has remained determined for years to stop the Russia-to-Germany NordStream 2 pipeline from becoming operational – which it succeeded in doing in February, as tensions over Ukraine worsened.

As the US has its own independent pricing system, it is not affected by the international gas prices, which are expected to rise significantly in the European and Asian markets, bringing instant value to LNG production activities in the US.

The EU plan to cut two-thirds of its Russian gas imports and replace it elsewhere – by the end of 2022 – is very optimistic. Closer scrutiny shows it will come with a very high cost – around five times the price that Europe used to pay. Whichever plan the EU implements, Europe will have to acknowledge that it will be neither an energy independent or politically independent continent for the foreseeable future.

The views expressed in this article do not necessarily reflect those of The Cradle.

READ MORE:

https://thecradle.co/Article/investigations/11641

READ FROM TOP.

Meanwhile the Russian incursion in Ukraine is making slow and careful progress.... By the end of next week, a third of Ukraine could be in Russian hands forever, unless Zelenskyyy-y decides to make a deal now (we know he won't)... Here one has to consider that the "incursion-front" is more than 1500 kilometres long — a distance from Melbourne to Coffs harbour.... or from Paris to Rome..... and that Russia has to monitor and control this line every 500 metres....

FREE JULIAN ASSANGE NOW

all hair, no brains…..

The European Commission said it is unable to locate text messages sent between its president, Ursula von der Leyen, and Pfizer CEO Albert Bourla during talks for a massive vaccine deal last year, but denied prior charges of “maladministration”from an EU watchdog.

The commission issued a letter on Wednesday stating that an expanded search for the missing messages had “not yielded any results,” following months of dispute between the EU’s executive body and oversight officials. It argued that due to the “short-lived and ephemeral nature” of texts, they typically “do not contain important information” and are therefore rarely stored.

While von der Leyen revealed in an April 2021 interview that she and Bourla privately communicated for several weeks while negotiating a contract for nearly 2 billion vaccine doses, a journalist’s public information request for the texts was later shot down, with the commission claiming it could not find the messages in question.

The denial triggered a rebuke from the European ombudsman, Emily O’Reilly, who followed up with an investigation last year and blasted EU officials over poor administration and a lack of transparency, saying that “no attempt was made to identify if any text messages existed.” The ombudsman then urged the commission to “search again,” asking it to broaden its criteria in a way that might actually locate the records.

READ MORE:

https://www.rt.com/news/558110-european-commission-pfizer-texts/

READ FROM TOP.

Ursula von der Leyen SHOULD RESIGN FROM HER EMPLOYMENT... and go and work in the salt mines.... or as an advisor to Pfizer...

FREE JULIAN ASSANGE NOW.