Search

Recent comments

- was Pepe sold a pup?....

28 min 59 sec ago - a peace deal....

20 hours 16 min ago - peace now!

21 hours 42 min ago - a nasty romance....

21 hours 47 min ago - blackmail?.....

1 day 18 min ago - ukraine's agony has not started yet....

1 day 17 hours ago - all defeated.....

1 day 18 hours ago - beyond crime.....

1 day 18 hours ago - the end....

1 day 19 hours ago - odessa....

1 day 20 hours ago

Democracy Links

Member's Off-site Blogs

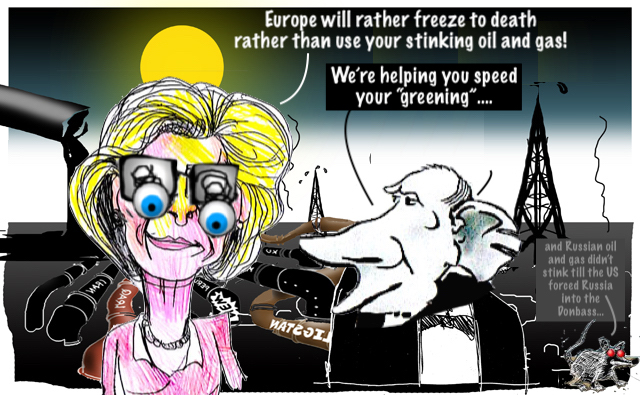

the greening of europe's energy is coming early….

I don’t think many Americans appreciate just how tense and tenuous, how very touch and go the energy situation in Europe is right now.

For months, as news of the Ukraine war receded a bit, it was possible to follow the energy story unfolding across the Atlantic and still assume an uncomfortable but familiar-enough winter in Europe, characterized primarily by high prices.

In recent weeks, the prospects have begun to look darker. In early August the European Union approved a request that member states reduce gas consumption by 15 percent — quite a large request and one that several initially balked at. In Spain, facing record-breaking heat wave after record-breaking heat wave at the height of the country’s tourist season, the government announced restrictions on commercial air-conditioning, which may not be set below 27 degrees Celsius, or about 80 degrees Fahrenheit. In France, an Associated Press article said, “urban guerrillas” are taking to the streets, shutting off storefront lights to reduce energy consumption. In the Netherlands a campaign called Flip the Switch is asking residents to limit showers to five minutes and to drop air-conditioning and clothes dryers entirely. Belgium has reversed plans to retire nuclear power plants, and Germany, having ruled out the possibility of such a turnabout in June, is now considering it as well.

READ MORE:

"Europe's energy crisis may get a lot worse."

FREE JULIAN ASSANGE NOW..............

- By Gus Leonisky at 15 Aug 2022 - 11:13am

- Gus Leonisky's blog

- Login or register to post comments

needs beat sanctions…..

The harsh sanctions imposed on Russia by the West over the conflict in Ukraine have so far been unable to deliver the desired result, The Economist magazine has acknowledged, adding that the strategy has “flaws.”

“Worryingly, so far the sanctions war is not going as well as expected,” the British publication said in its article on Thursday, insisting that the effectiveness of economic restrictions on Moscow “is key to the outcome of the Ukraine war.”

“Russia’s GDP will shrink by 6% in 2022, reckons the IMF, much less than the 15% drop many expected in March... Energy sales will generate a current-account surplus of $265 billion this year, the world’s second-largest after China. After a crunch, Russia’s financial system has stabilized and the country is finding new suppliers for some imports, including China,” it pointed out.

At the same time, the energy crisis, which has been provoked by the sanctions war, “may trigger a recession” in Europe, where gas prices spiked by another 20% this week, according to the British magazine.

This all means that the expected “knockout blow [from restricting Russia] has not materialized,” The Economist said.

The unipolar moment of the 1990s, when America’s supremacy was uncontested, is long gone, and the West’s appetite to use military force has waned since the wars in Iraq and Afghanistan,” it acknowledged.

Economic restrictions “seemed” to be the new tool that would allow the US, EU and its allies to project their power globally, but the conflict in Ukraine has revealed that “the sanctions weapon has flaws,” it said.

One of those flaws is “the time lag,” the magazine continued. For example, “blocking [Russia’s] access to tech the West monopolizes takes years to bite,” it added.

The Economist suggested that isolation from Western markets could only “cause havoc in Russia… on a three- to five-year horizon.”

“The biggest flaw [of sanctions] is that full or partial embargoes are not being enforced by over 100 countries with 40% of world GDP,” the outlet insisted. “A globalized economy is good at adapting to shocks and opportunities, particularly as most countries have no desire to enforce Western policy.”

READ MORE: Coca-Cola reluctant to leave RussiaWith economic curbs failing to cripple the Russian economy, one should “discard any illusions that sanctions offer the West a cheap and asymmetric way to confront China” if it decides to use force against Taiwan, The Economist warned.

READ MORE:

https://www.rt.com/news/561634-sanctions-ukraine-china-economist/

READ FROM TOP.

THE ECONOMIST IS AN ELEGANT RAG THAT TRIES TO BE DECENT BUT MISSES THE MARK BY BEING NAIVE ON THE GEOPOLITICAL GAMES BEING PLAYED.... EVEN AMERICA IS BUYING STUFF FROM RUSSIA BECAUSE OF THE NEEDS OF INDUSTRIES AND SUCH.... SAY:

Hundreds of various types of unsanctioned Russian goods worth billions of dollars continue to flow into US ports, Associated Press reported on Thursday.

The report highlighted that over 3,600 shipments of wood, metals, rubber and other goods have arrived at American ports from Russia since February. “That’s a significant drop from the same period in 2021, when about 6,000 shipments arrived, but it still adds up to more than $1 billion worth of commerce a month,” AP wrote, adding that cargoes arrive at US ports almost every day.

It also noted that “Banning imports of certain items would likely do more harm to those sectors in the US than in Russia.” Some US importers reportedly get alternative materials elsewhere, but many others do not have such choice.

The shipped items are “clearly legal and even encouraged by the Biden administration,” according to the report. However, in some cases, the origin of products shipped out of Russian ports can be difficult to discern. For example, US energy companies are continuing to import oil from Kazakhstan through Russian ports, even though that oil is sometimes mixed with the banned Russian fuel.

Russia is a key exporter of metals like aluminum, steel and titanium, Morgan Stanley economist Jacob Nell told AP, explaining that cutting off that trade could dramatically push up prices for Americans already grappling with inflation.

“The basic idea with sanctions is that you’re trying to act in a way that causes more pain to the other side and less pain to yourself,” he said.

READ MORE:

https://www.rt.com/business/561620-us-continues-import-russian-goods/

GUSNOTE:

SHANGHAI, Apr 25 (SMM) - According to the latest customs data, in the first quarter of 2022, China exported a total of 6,450 mt of tungsten products, a year-on-year increase of 28.1%. Among them, the cumulative export of tungsten trioxide was 1,503 mt, a year-on-year increase of 34.9%, and that of ammonium paratungstate was 744 mt, up by 40.4% year-on-year. The export volume of ferrotungsten was 952 mt, a year-on-year increase of 119.9%, and that of tungsten powder was 403 mt, a year-on-year decrease of 8.25%.

In March 2022, the export volume of tungsten trioxide, ferrotungsten, tungsten powder, and tungsten bars in China increased by 33%, 443%, 63.7%, and 1.3% respectively year-on-year.

Compared with the export volume of ferrotungsten in previous months, the export volume in March 2022 in China surged, with the total export volume standing at 543 mt, up 443% YoY and 119% MoM. Among them, 682 mt were exported to the Netherlands in March, accounting for 72% of the total, with an average price of 174,000 yuan/mt; 163 mt were exported to Japan, accounting for 17% of the total, with an average price of 195,000 yuan/mt; 83 mt were exported to South Korea, accounting for 9% of the total, with an average price of 173,000 yuan/ton; 20 mt were exported to the US, accounting for 7% of the total, with an average price of 211,000 yuan/mt; 4.5 mt were exported to Australia, accounting for 2% of the total, with an average price of 212,000 yuan/mt.

In March, with the full-scale outbreak of the Russia-Ukraine conflict, Europe and the US imposed economic sanctions and trade sanctions on Russia to varying degrees, hindering the exports of Russian resources. Due to the sanctions on Russia, countries that have demand for Russian tungsten products, especially for ferrotungsten, a product used in special steel, shifted their attention to China, hence the export volume of ferrotungsten in China increased sharply. In terms of price, prices of raw materials in China continued to rise, and the spot stock of ferrotungsten in March was not much, pushing up the prices of exported ferrotungsten.

Generally speaking, in the first quarter, the export of tungsten products in China was cheering. However, the export of tungsten products will be easily affected by unexpected situations such as the international situation and the airline transportation. In the long run, China is the main supplier of tungsten products, and the overall demand overseas is relatively stable. However, the continuous rise of prices will reduce the number of orders for some time, especially when international inflation is getting more and more serious, resulting in a sluggish market or arousing a wait-and-see sentiment in the market.

READ MORE:

https://news.metal.com/newscontent/101815683/chinas-tungsten-exports-hit-a-new-high-due-to-the-russia-ukraine-conflict/

NOW, PAY ATTENTION: WHAT STOPS CHINA FROM BUYING TUNGSTEN PRODUCTS FROM RUSSIA AND RESELL IT AS ITS OWN? NOTHING....

SEE ALSO:

wheeling and dealing in uranium…… and remembering when….FREE JULIAN ASSANGE NOW.....................

mexican waving….

Imports of Russian goods by Mexico saw a substantial annual increase of more than 20% during the first six months of the current year, according to the latest figures released by the Bank of Mexico.

In monetary terms, Mexican imports from Russia amounted to $1.193 billion. In June alone, purchases of Russian goods by the North American nation exceeded $275 million – the second-highest figure in Mexico’s history. In May 2021, the country bought Russian goods worth $283.9 million.

In 2021, trade turnover between the two countries reached a record high, exceeding $4.5 billion.

The US remains Mexico’s most important trading partner. In 2021, the trade turnover between the two countries amounted to more than $661 billion. In July, Foreign Minister Marcelo Ebrard announced that American companies were planning to invest $40 billion in the Mexican economy by 2024

READ MORE: G20 states revolt against US pressure – BloombergRussia is the key international supplier of fertilizers to Mexico, accounting for nearly a quarter of all Mexican imports of nitrogen and mixed nitrogen, phosphorus and potash fertilizers.

Rolled steel, aluminum, and synthetic rubber are among the country’s other important imports from Russia.

READ MORE:

https://www.rt.com/business/561636-mexico-imports-russia-surge/

READ FROM TOP.

FREE JULIAN ASSANGE NOW (KEEPING ASSANGE IN PRISON SHOWS THE SUPERB U.S. HYPOCRISY)