Search

Recent comments

- UK-israhell.....

4 hours 25 min ago - albania.....

4 hours 33 min ago - israhell crap.....

4 hours 51 min ago - waste of cash....

7 hours 29 min ago - marles' bluster....

7 hours 51 min ago - fascism français....

7 hours 55 min ago - russian subs in swedish waters....

8 hours 34 min ago - more polling....

8 hours 2 min ago - they know....

12 hours 51 min ago - past readings....

13 hours 50 min ago

Democracy Links

Member's Off-site Blogs

credentials versus bodgies...

- By Gus Leonisky at 16 Aug 2010 - 5:56pm

- Gus Leonisky's blog

- Login or register to post comments

an open letter

We the undersigned economists are convinced by the evidence that the coordinated policies of the

Australian Labor Government have prevented the Australian economy from a deep recession and

prevented a massive increase in unemployment. Unlike most OECD economies we have come out of the

Global Financial Crisis and the subsequent world recession with only one quarter of negative GDP

growth and a smaller increase in unemployment.

We note that during a recession automatic stabilizers (increase in total unemployment benefit payments

and decreased tax revenues) lead to an increased government budget deficit. In almost all the OECD

countries there has been a massive increase in unemployment and in budget deficits. In Australia both

have been trivial by comparison.

The Government Fiscal Stimulus package that was introduced was carefully crafted and implemented in a

clever sequence. The first stage, the payment of $900 to most households, helped to boost confidence in

the retail industry.

The second stage of the stimulus package (the Building Education Revolution, and the First Home

Owners Grant) boosted the construction industry and created thousands of new jobs. Besides the

employment effect, it also provided a much needed increase in the stock of public capital (better and

greener homes, better schools) and prevented a sudden fall in house prices.

The last stage of the fiscal stimulus package (as it takes time to prepare plans etc.) was the infrastructure

program that increased employment as well as increasing the stock of public capital and helping to

overcome the significant short fall in Australian public infrastructure, and hence would increase future

productivity, taxable capacity and the ability to repay public debt.

Just as a major corporation goes into debt to invest in its stock of capital, so does a government. Just as

many householders have a debt to a bank or mortgage company, so does a government. A government has

a budget deficit and a government debt, but it also has capital assets (roads, ports, better equipped

schools, Broadband, etc.).

The performance of the Australian economy has been outstanding: the International Monetary Fund

(IMF) and the Organisation for the Economic Cooperation and Development (OECD) have show-cased

Australia as a model economy.

We hope that the economic achievements of the Australian Labor Government will be recognized by the

population.

Name Position Institution

P.N. (Raja) Junankar Emeritus Professor UWS, UNSW, and IZA

G. C. Harcourt Emeritus Professor UNSW and Jesus College, Cambridge

Peter Kriesler Associate Professor UNSW

John Nevile Emeritus Professor UNSW

George Argyrous Senior Lecturer University Of New South Wales

Harry Bloch Professor Curtin University

Tony Bryant Associate Professor Macquarie University

John Buchanan Director, Workplace Research Centre University of Sydney

Jerry Courvisanos Associate Professor University of Ballarat

Mamta B Chowdhury Senior Lecturer University of Western Sydney

Barrie Dyster Senior Lecturer University Of New South Wales

Corrado Di Guilmi Post Doctoral Research Fellow University of Technology

Geoff Dow Reader The University of Queensland

Steve Dowrick Professor Australian National University

Chris Evans Professor University Of New South Wales

Peter E. Earl Associate Professor University of Queensland

Craig Freedman Associate Professor Macquarie University

Giuseppe Fontana Professor of Monetary Economics LUBS - University of Leeds

James Farrell Senior Lecturer University of Western Sydney

Roy Green Dean, Faculty of Business University of Technology

Boyd Hunter Associate Professor/Senior Fellow The Australian National University

Joseph Halevi Senior Lecturer University of Sydney

Neil Hart Senior Lecturer University of Western Sydney

Sasha Holley PhD student University of Sydney

Michael Johnson Associate Professor University Of New South Wales

Steve Keen Associate Professor University of Western Sydney

Bill Lucarelli Senior Lecturer University of Western Sydney

Bruce Littleboy Senior Lecturer University of Queensland

Marc Lombard Senior Lecturer Macquarie University

Elisabetta Magnani Associate Professor University Of New South Wales

Fiona Martin Senior Lecturer University Of New South Wales

Girijasankar Mallik Senior Lecturer University of Western Sydney

Robert Marks Visiting Professor University Of New South Wales

Stephane Mahuteau Senior Lecturer Macquarie University

Eddie Oczkowski Professor Charles Sturt University

Brian Pinkstone Associate Professor University of Western Sydney

John Quiggin Australian Research Council Federation Fellow, University of Queensland

B. Bhaskara (Bill) Rao Professor University of Western Sydney

Colin Richardson Visiting Professor of Economics Imperial College, London

Tim Robinson Professor University of Technology

Frank Stilwell Professor of Political Economy University of Sydney

Ingrid Schraner Senior Lecturer University of Western Sydney

Michael Schneider Honorary Fellow. La Trobe University

Ruhul Salim Associate Professor Curtin University

Chris Terry Associate Professor University of Technology

David Throsby Professor of Economics Macquarie University

Tim Thornton Associate Lecturer La Trobe

Phillip Toner Senior Research Fellow University of Western Sydney

Roger Tonkin Lecturer Macquarie University

Sean Turnell Senior Lecturer Macquarie University

Michael White Senior Lecturer Monash university

Other Signatories

James Arvanitakis Lecturer, Centre for Cultural Research University of Western Sydney

Nixon Apple Industry and Economic Advisor Australian Manufacturing Workers Union

Grant Belchamber Economist ACTU

Ross Buckley Professor of International Finance Law University Of New South Wales

Brad Crofts National Economist Australian Workers' Union

Rajinder Cullinan Client Services Accountant University Of New South Wales

Sandra Egger Associate Professor Faculty of Law, University of New South Wales

Rolf Gerritsen Professor, School for Social Policy and Research Charles Darwin University

Alan Morris Senior Lecturer University Of New South Wales

George McFarlane Retired Consultant, Sanders & Associates Pty Ltd

Gillian Moon Senior Lecturer University Of New South Wales

John Milfull Emeritus Professor University Of New South Wales

J. F. Pixley Senior Research Fellow Macquarie University

Ben Spies-Butcher Lecturer Macquarie University

Peter Sheldon Associate Professor University Of New South Wales

Gus would sign that letter too...

I Wish I could sign it and and carry some influence too Gus.

I know what the neo-Nazi Kruger will say - "They are only Union thugs".

What a marvellous credit that is to the honesty and economic ability of the Rudd/Gillard and Wayne Swan front bench that proved and by definition, disproved the false claims of the Mining Industry their media Corporations and their Parliamentary representatives - the Liberal/Nationals.

Can we forgive Abbott for being so stupid? Or dishonest? Or more appropriately, can we believe any member of their front bench? Or any candidate they put forward with their policies of their economic prowess when they tried to block the stimulus package that saved some 200,000 jobs? This while the mainly foreign owned Resource Miners sacked 15% of their workers and were complimented by the Liberal/Nationalists?

Will we forgive the Corporation's media baron Murdoch if he does not allow the printing of this ever so important message that should put the question of Labor talent in economy to the forefront and the absence of the same in the Coalition?

Perhaps the vision of the pipe smoking ex-train driver Prime Minister, Ben Chifley, has given Julia a little momentum with us oldies. Those were the days when gender was not a debate but, ability was the key factor and our media - with its unintended faults which is expected in difficult times was informative NOT dictatorial.

Not so now since Murdoch has played “king maker” in every country with his snake salesmanship approach to power, which should be measured by his journalist’s illegally used OPINIONS for a boss who is too rich to be controlled by the people?

If the Corporation’s Foreign Media and their some 26 UNIONS (by whatever name) really cannot see the issue of a class war then they should try honesty as a genuine expense of their not so obvious wish for their toil to benefit all Australians of any class.

In Abbott’s rapidly made speech recently, he did not confide in us that almost all of the countries where the Foreign Miners could get a better deal than Australia were third world countries primarily from Africa. And badly exploited.

So, one can confidently surmise that Phoney Tony and his patched up “New Order” thinks of our nation as just third world status (which Keating warned us about) and entitled to no more? As long as they control the government.

Fair dinkum. NE OUBLIE.

soooo what?

The SMH is in rapture to have discovered Julia spoke "with promts"... SOOOO WHAT????

This does not mean she did not speak from the heart nor that she looked at the notes... So, BUGGER OFF Herald...

That takes the cake of hypocrisy when Libshit Tony used a telepromter to push his CRAFTED lies in our faces...

Let me spew on your newspaper. YOU STINK OF SPIN...

------------------------

Even a cursory glance showed it was a written speech. A closer inspection showed it was the very speech she had delivered, word for word.

It was a near faultless speech, barely a stumble - and the PM hardly glanced at her notes, giving the impression she has a near-photographic memory.

But so much for Julia unplugged. A case, you might think, of too much spin. No one would have cared a fig if she had read the whole thing...if only we hadn't been hoodwinked into believing this was a free-form plea from her soul.

http://www.smh.com.au/federal-election/the-hidden-truth-behind-the-pms-impromptu-speech-20100817-127hr.html?autostart=1

of china and australia

from Ross Gittins

We may live in a globalised world but it hasn't made our election campaigns any less parochial and inward-looking. Perhaps in an effort to raise Australians' economic literacy, the Economic Society recently sponsored a national tour by Professor Joe Stiglitz, a Nobel prize winner and one of the world's most illustrious economists.

Some brave soul asked him if he'd learnt anything while he was here. Well, he said politely, there were a few things that had puzzled him. He couldn't understand why we didn't know the success of the Rudd government's budgetary stimulus - explained by its size, timing and design - was the envy of the other G20 countries.

He couldn't understand why we were so worried about budget deficits and debt when our accumulated federal government debt was about 5 per cent of gross domestic product, whereas just one year's budget deficit in the US was 10 per cent of its GDP. And he couldn't understand why so many people were opposed to requiring the mining companies to pay a fair price for the use of our resources.

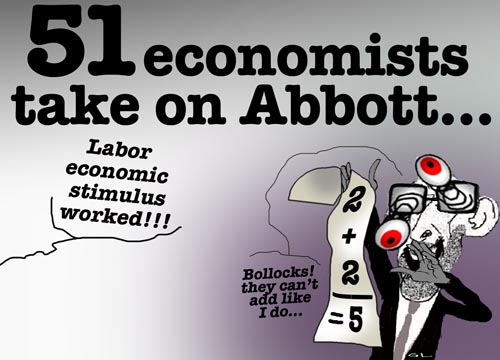

Now more than 50 Australian economists have issued a statement saying they're ''convinced by the evidence that the co-ordinated policies of the Australian Labor government have prevented the Australian economy from a deep recession and prevented a massive increase in unemployment''.

-----------------------

Gus: Tony Abbott seems to be the only mug on earth who does not want to see this... Tony chooses to be blind to the bleeding obvious... And his Libshit cronies are in rapture with his crappy views because they can sense the whiff of "victory" at whatever expense — the demise of truth, the denigration of the Australia people and the killing of democracy in general by sharp porky. Big lying has become the norm in the rank of the Libshits... It is my view that Joe Hockey and Malcolm Turnbull should resign forthwith from this madhouse or they shall be tarred with the same brush as Tony...

Meanwhile, China is forgotten, as if the Chinese did not feel the pinch of the worldwide monetary crash. A monetary crash that Tony-the-Fibber claims lasted only eight weeks... Eight weeks??? Idiot!!! Pommyland and Yamerica are still in the doldrum from an economic meltdown that started in 2007 under the wasteful watch of another of Tony's idols — Bushit the minus... We're now in 2010 and unemployment in the USA is hovering around 10 per cent. UK finances are shot. The major trouble with the rescue packages in those countries is that they did not shoot the culprits: the bankers... which Tony-da-Phoney, of course, would have lavishly dined and moneyed... Lucky Australia was in the hand of Labor. The Libshits are not needed to unpick the good work...

Back to the Chinese. They quietly did the same as Australia. They did not "rescue" the banks but "voted" to implement stimulus packages of infrastructure and development for themselves. It worked there too. All the countries who paid off the banks are still in trouble. Australia and China were the only "advanced" economies to go a different route.

Piss off Tony. You cannot say that "the voters don't owe anthing to Labor". That is sociopathic lying to the extreme.

meanwhile at the negative return, for necessities...

Coalition infrastructure plan 'a drop in the ocean'

Call them Clayton's infrastructure bonds: the infrastructure bonds you announce when you have promised to cut public debt.

Initial media reports left many with the impression that a potential Coalition Government was planning to issue infrastructure bonds to fund key projects.

However, the Coalition's actual policy is to get the Commonwealth's Office of Financial Management (OFM) to look at the feasibility and desirability of issuing infrastructure partnership bonds, in consultation with financial market participants.

And the Opposition Leader Tony Abbott was quick to stamp out any misapprehension that these potential infrastructure bonds would be issued by the Federal Government, adding to the Commonwealth's debt.

"The infrastructure bonds that we talked about today are certainly not Government debt," he told the National Press Club.

"What we talked about today was providing a tax incentive for private individuals and entities that invest in infrastructure projects that are approved by infrastructure Australia - so it's a tax break to make private investment in infrastructure more advantageous and attractive."

...

But economist Dr Mike Rafferty, the senior research analyst at Sydney University's Workplace Research Centre, says this is precisely the main flaw of the proposal, as many projects that have a great public social or economic benefit have relatively little potential for private profit.

He says that means projects will still either need to offer a reasonable commercial rate of return, or be publicly subsidised by some level of government, to proceed.

"It's not really going to take many projects over the line that would be marginal to now being viable," he told ABC News Online.

"There are a lot of big projects in infrastructure that only governments would do because they do have benefits which spill over across the economy and across society more generally, and so clearly the ones that will get funded are the ones that have the highest internal rate of return - that is, the highest rate of profit to the developers.

-----------------------

Meanwhile Tony has promised $60 million to the film industry... Is Mr Murdoch Fox studios included in this generous giveaway? I know some smart Aussie investors who have done marvellous "international" movies — some not released yet. Would this money benefit them as well? Sure the film industry in this country needs a bit of help but is this an expensive coalition way to shut Phillip Adams up rather than help the production of better Aussie films? Is this a non-core promise?

... And I don't really care what Tony's boys are promising. They could promise the moon and I would not want it from them. Too much disdain, glibness and sarcasm attached...

thick brain and water in his boots...

AUSTRALIA'S economists are wrong to believe a carbon price is the best way to reduce greenhouse gas emissions, the Opposition Leader, Tony Abbott, said yesterday as another expert report concluded a carbon price would be the most efficient policy.

Speaking at the Melbourne Institute conference, Mr Abbott said economists who thought a carbon price was more efficient should ''think again''.

''It may well be … that most Australian economists think that a carbon price or emissions trading scheme is the way to go,'' he said. ''Maybe that's a comment on the quality of our economists rather than on the merits of the argument.''

Read more: http://www.smh.com.au/environment/climate-change/abbott-lashes-out-as-another-report-backs-carbon-tax-20110701-1gv3y.html#ixzz1Qwsp8g7d

Tony, Tony... The more you argue about it the less intelligence you show... We'll give half a point though for determination and doggedness and we'll give you a minus one for your bile. See toon at top...

a daring new approach?

A daring new approach to solving the economic slump that has taken hold in Europe is gaining popularity in official circles.

Helicopter money refers to money figuratively “dropped from the sky”, or freshly created cash used to fund infrastructure projects or put directly into the hands of citizens.

Rather than being thrown from the sky, helicopter money might mean every UK citizen being credited with, say, £500 from the central bank straight into their current account.

read more: http://www.independent.co.uk/news/business/news/helicopter-money-adair-turner-recession-interest-rates-draghi-osborne-economy-a7027621.html

-------------

Gus: Here in Australia, $900 cash given to the people by the government (Labor) was successful to combat the GFC, despite what opposition leader then Tony Turdy Abbott (Liberal — CONservative) claimed. IT WORKED. So it's not a daring new approach. It was designed to give power of purchase directly to the people rather than through the banks which would have taken their cut — or absorbed the "rescue package" in their own books... Read from top.