Search

Recent comments

- waste of cash....

1 hour 21 min ago - marles' bluster....

1 hour 43 min ago - fascism français....

1 hour 47 min ago - russian subs in swedish waters....

2 hours 26 min ago - more polling....

1 hour 54 min ago - they know....

6 hours 42 min ago - past readings....

7 hours 42 min ago - jihadist bob.....

7 hours 48 min ago - macronicon.....

9 hours 42 min ago - fascist liberals....

9 hours 43 min ago

Democracy Links

Member's Off-site Blogs

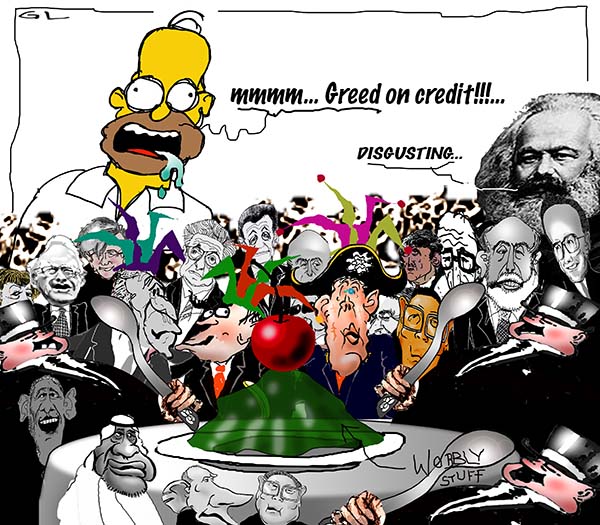

most of the characters have moved on, but the problem they created has gone worse: greed on credit...

Debt is higher than before the global financial crisis, making the world vulnerable to economic and market shocks, S&P Global Ratings has warned.

Key points:- The world's debt-to-GDP ratio has risen from 208pc in June 2018 to 234pc in June 2018

- Emerging markets now account for 31pc of global credit, more than double the proportion in 2008

- Chinese companies make up two-fifths of the riskiest corporate debtors

The debt-to-GDP ratio of 234 per cent in June 2018 was considerably higher than 208 per cent in 2008.

But even though the debts are bigger, the big three credit ratings agency believes the risk of a major credit crunch and financial crisis is smaller.

"Global debt is certainly higher — and in many cases riskier — than a decade ago," the report warned.

"Nonetheless, the likelihood of a widespread investor exodus is contained.

"The increased debt is largely driven by advanced-economy sovereign borrowing and domestic-funded Chinese companies, thus mitigating contagion risk."

In absolute terms, the US led the increase in government debt, with an extra $US10.6 trillion in borrowings. China was next at $US5 trillion, and the eurozone borrowed $US2.8 trillion more.

However, on a debt-to-GDP basis, China grew its indebtedness by 71 per cent — albeit from a low base — the US by 60 per cent, and the eurozone by 45 per cent.

Read more:

https://www.abc.net.au/news/2019-03-12/debt-crisis-brewing-but-dont-expe...

The toon at top was posted 10 years ago under greed on credit. There, we attempted to show the terrible manipulations of the capitalist system that relies on growth, following the 2008 GFC (global financial crisis). Since then, more of the planet is suffering from our greed. Global warming was not an invention to make us curb our excess. Global warming is a simple reactive phenomenon of all the parameters of the planet responding without any moral judgement of our burning fossil fuels which is central to 90 per cent of our human greed. This also includes population growth, food supplies and travel.

The ownership of the debt also shows an inequality of classes and countries. Most of the burden has been shifted onto poor people for the last 2,000 years. Kings don't have debts. They rob the middle class that robs the poor. When kings (presidents, etc) run out of cash, they either raise taxes (unpopular with the middle class) or print money (unpopular with the rich). Most of the debt has been created by the Western system of capitalism, centred around the USofA printing US$ 22 trillion more than the USofA "owns" OFFICIALLY. The debt is actually much bigger and as shown by the previous GFC, some of the personal debt of the middle class was also monumental and unserviceable. These debts have enriched that country with a vast illusion. These massive debts are the fuel of the empire and no-one can ask for their money back. All they will get is an IOU for money that never existed.

- By Gus Leonisky at 12 Mar 2019 - 7:16pm

- Gus Leonisky's blog

- Login or register to post comments

chuck should advise trump...

I thought this was quite hilarious.

it comes from the Christian Post. Chuck Bentley is CEO of Crown Financial Ministries, the largest (of course) Christian financial ministry in the world, founded by the late Larry Burkett. Chuck is the host of a daily radio broadcast, My MoneyLife, featured on more than 1,000 Christian Music and Talk stations in the U.S., and author of his most recent book, Money Problems, Marriage Solutions.

That's it. Blokes find yourself a rich woman or was it Ladies find a sugar daddy?... Just kidding. This is serious...

--------------------------

Dear Chuck,

I read that America has dangerous levels of federal debt but also read that it really doesn’t matter. Which is it? And what should I do about it?

Worried Taxpayer

----------

Dear Worried,

America’s federal debt has recently swelled to twenty-two trillion dollars. Those are numbers that were once used only in the field of astronomy.

This is a confusing topic because it is impossible to accurately predict a tipping point for our national debt. The danger lies in our ability or inability to respond to a future crisis. It is my opinion that regardless of our government’s debt, believers should manage their finances in a way that honors the Lord: prepared for a crisis and not living dependent on the government.

Some make the argument that our debt doesn’t matter because America has an advantage over many nations. We have abundant natural resources, one political system, one monetary system, one primary language, fairly peaceful neighbors, and a population that all grant confidence for foreign investors. All true.

Our government debt is not an immediate concern for many because interest rates are low. However, if our lenders ever lose confidence in the good faith and credit of the U.S., then our debt could actually become a real threat. There are those who believe the Modern Monetary Theory in which a government in control of its currency just prints more as needed. Deficits don’t matter to MMT-ers, because the government can’t go broke. So they believe.

Despite the Naysayers, Debt is a Real Concern

Pete Peterson, for Newsweek in 2009 stated,

For years, I have been saying that the American government, and America itself, has to change its spending and borrowing policies: the tens of trillions of dollars in unfunded entitlements and promises, the dangerous dependence on foreign capital, our pitiful level of savings, the metastasizing health-care costs, our energy gluttony. These structural deficits are unsustainable.

Martin Crutsinger, at apnews.com, wrote:

The national debt is the total of the annual budget deficits. The Congressional Budget Office projects that this year’s deficit will be $897 billion – a 15.1 percent increase over last year’s imbalance of $779 billion. In the coming years, the CBO forecasts that the deficit will keep rising, top $1 trillion annually beginning in 2022 and never drop below $1 trillion through 2029. Much of the increase will come from mounting costs to fund Social Security and Medicare as the vast generation of baby boomers continue to retire.

Binyamin Appelbaum, with the New York Times, reported:

Economists have warned that government borrowing would limit private sector borrowing, which would constrain economic growth; that it would drive up inflation; and even that the government might find itself unable to borrow, if creditors presumed the United States was too deep in debt and might be unable to make interest payments or repay its liabilities in full.

Michael A. Peterson remarked that the federal debt “threatens the economic future of every American” when the $22 trillion milestone was crossed.

And, yet, investors still have confidence in the power of the U.S. economy. Bob Doll’s Weekly Investment Commentary for Nuveen states:

Rising debt issues are a concern but fundamentals still look decent. The overall debt profile of the U.S. government is worsening, which could present significant economic issues over time. But household and corporate debt levels are healthy, and we don’t think we are entering an environment of serious credit issues.

The Bible Warns Against Debt

The rich rules over the poor, and the borrower is the slave of the lender. (Proverbs 22:7 ESV)

For the Lord your God will bless you as he has promised, and you will lend to many nations but will borrow from none. You will rule over many nations but none will rule over you. (Deuteronomy 15:6 ESV)

And you shall lend to many nations, but you shall not borrow. And the Lord will make you the head and not the tail, and you shall only go up and not down, if you obey the commandments of the Lord your God. (Deuteronomy 28:12b-13a ESV)

It is easy to see the speck in government spending, but fail to see a log in our own eyes. Consider these recent statistics on personal debt in America:

Is our leadership influencing the populace? Does a government that runs on borrowed money endorse its people to do likewise? How would this nation look if it ran contrary to that fact; a nation with reserves protecting its people and prepared for unexpected emergencies?

It is easy to cast stones at the government’s debt and ignore our own. Americans in general have financial issues. We must ask ourselves if we are influencing culture or whether the culture is influencing us.

Compare our government and personal debt to a volcano. It can appear beautiful from a distance, but stretching far below the surface, hidden channels of hot magma are accumulating. Pressure is building, and at some point, the stress becomes so great that it erupts, and anything in its path gets burned.

Volcanologists can predict eruptions if they understand the volcano’s history and can monitor data from properly installed equipment. Even then, it is not possible to accurately predict the severity of the eruption.

So regardless of whether our government ever stops piling on more debt or will one day reign it in, we need to manage our personal finances in such a way as to reflect the wisdom of God. Minimize your personal debt, increase your savings, and lay up for yourselves treasures in Heaven where you have a guarantee on the safekeeping of your investments.

If you need to take the first step towards paying off overwhelming credit card debt (hopefully it’s still less than $22 trillion), get in touch with our friends at Christian Credit Counselors. We trust them because they help you attack your debt the right way. Over 300,000 families have already lifted the burden of credit card debt with their help, and you can, too.

Gus is a rabid atheist. The major problem is that the cure for the human debt will most likely exacerbate the planetary natural deficit: produce more stuff to earn more cash while going backwards or buy less stuff and create a recession. Either way we're (or the system is) stuffed...Stealing the oil from Venezuela might help as well...

the next jarring and painful crack-up will be worse...

From Dmitry Orlov, one of the better-known thinkers The New Yorker dubbed ‘The Dystopians’ in an excellent 2009 profile. These theorists believe that modern society is headed for a jarring and painful crack-up. Orlov is best known for his 2011 book comparing Soviet and American collapse (he thinks America’s will be worse). He is a prolific author on a wide array of subjects and has a large following on the web, and on Patreon.

An article I published close to five years ago, “Putin to Western elites: Play-time is over”, turned out to be the most popular thing I’ve written so far, having garnered over 200,000 reads over the intervening years. In it I wrote about Putin’s speech at the 2014 Valdai Club conference. In that speech he defined the new rules by which Russia conducts its foreign policy: out in the open, in full public view, as a sovereign nation among other sovereign nations, asserting its national interests and demanding to be treated as an equal. Yet again, Western elites failed to listen to him.

Instead of mutually beneficial cooperation they continued to speak the language of empty accusations and counterproductive yet toothless sanctions. And so, in yesterday’s address to Russia’s National Assembly Putin sounded note of complete and utter disdain and contempt for his “Western partners,” as he has usually called them. This time he called them “swine.”

The president’s annual address to the National Assembly is a rather big deal. Russia’s National Assembly is quite unlike that of, say, Venezuela, which really just consists of some obscure nonentity named Juan recording Youtube videos in his apartment. In Russia, the gathering is a who’s-who of Russian politics, including cabinet ministers, Kremlin staffers, the parliament (State Duma), regional governors, business leaders and political experts, along with a huge crowd of journalists. One thing that stood out at this year’s address was the very high level of tension in the hall: the atmosphere seemed charged with electricity.

It quickly became obvious why the upper echelon of Russia’s state bureaucracy was nervous: Putin’s speech was part marching orders part harangue. His plans for the next couple of years are extremely ambitious, as he himself admitted. The plank is set very high, he said, and those who are not up to the challenge have no business going near it. Very hard work lies ahead for almost everyone who was gathered in that hall, and those of them who fail at their tasks are unlikely to be in attendance the next time around because their careers will have ended in disgrace.

The address contained almost no bad news and quite a lot of very good news. Russia’s financial reserves are more than sufficient to cover its entire external debt, both public and private. Non-energy-resource exports are booming to such an extent that Russia no longer needs oil and gas exports to maintain a positive balance of trade. It has become largely immune to Western sanctions. Eurasian integration projects are going extremely well. Russian government’s investments in industry are paying dividends.

The government has amassed vast amounts of capital which it will now spend on domestic programs designed to benefit the people, to help Russians live longer, healthier lives and have more children. “More children—lower taxes” was one of the catchier slogans.

This was what most of the address was about: eradication of remaining poverty; low, subsidized mortgage rates for families with two or more children; pensions indexed to inflation above and beyond the official minimal income levels (corrected and paid out retroactively); high-speed internet for each and every school; universal access to health care through a network of rural clinics; several new world-class oncology clinics; support for tech start-ups; a “social contract” program that helps people start small businesses; another program called “ticket to the future” that allows sixth-graders to choose a career path that includes directed study programs, mentorships and apprenticeships; lots of new infrastructure projects such as the soon-to-be-opened Autobahn between Moscow and St. Petersburg, revamped trash collection and recycling and major air pollution reductions in a dozen major cities; the list goes on and on.

No opposition to these proposals worth mentioning was voiced in any of the commentary that followed on news programs and talk shows; after all, who could possibly be against spending amassed capital on projects that help the population?

...

It is in speaking of them that Putin used the most withering word in his entire address. Speaking of Americans’ dishonesty and bad faith in accusing Russia of violating the ABM treaty while it was they themselves who were violating it, he added: “…and the American satellites oink along with them.” It is rather difficult to come up with an adequate translation for the Russian verb “подхрюкивать”; “oink along with” is as close as I am able to get. The mental image is of a chorus of little pigs accompanying a big swine. The implication is obvious: Putin thinks that the Americans are swine, and that their NATO satellites are swine too. Therefore, they shouldn’t expect Putin to scatter any pearls before them and, in any case, he’ll be too busy helping Russians live better lives to pay any attention to them.

Read more:

https://off-guardian.org/2019/03/11/putin-now-thinks-western-elites-are-...

we cannot afford to ignore social inequality...

Former Indian central bank governor Raghuram Rajan has warned capitalism is "under serious threat" as it has stopped providing for the masses.

Mr Rajan told BBC Radio 4's Today Programme "when that happens, the many revolt against capitalism".

He said governments cannot afford to ignore social inequality when considering the economy.

Mr Rajan led India's central bank and was also a former chief economist at the International Monetary Fund (IMF).

He has been tipped by some as a possible successor to take over from Mark Carney as governor of the Bank of England.

Read more:

https://www.bbc.com/news/business-47532522

buy your next war on credit...

The Trump administration is trying once more to fund a program for providing its allies with loans to buy US military equipment. The lion’s share would go to three major buyers of US weapons: Egypt, Jordan and Israel.

US President Donald Trump's proposed 2020 budget includes $5.4 billion for the Foreign Military Financing (FMF) grant assistance program; however, a US State Department official told Defense One Tuesday that the Trump administration really wants $8 billion for the fund.

Jointly managed by the Defense and State Departments, the FMF program provides US defense partners with loans to buy US equipment: funding that averages annually around $10.5 billion by DOD and $8.1 billion by the State Department, according to a February 2018 report on the FY 2019 budget by the Congressional Research Service.

However, Trump's proposal revives a plan torpedoed in 2017 to fund grants, too, "so that America can still be the defense supplier of choice for partner countries for which loans are not the best option."

"This expanded set of FMF tools would help support increased US defense sales and increase opportunities for allies and partners to build their militaries around US innovation and quality," the budget proposal, submitted Monday, states.

...

William Hartung, director of the Arms and Security Project at the Center for International Policy, told Defense One that buyers defaulted on loans several times in the 1980s and subsequently looked elsewhere for more generous terms.

What motivates the administration now is the fear that better terms from "near peer" adversaries like China and Russia will attract buyers away from American defense companies.

"Pretty much anywhere where we would like to see partners deepen and strengthen the relationship with US by investing in the diplomatic partnership, that comes with building your defense capabilities by buying American," the unnamed State Department official told Defense One.

Read more:

https://sputniknews.com/us/201903121073175497-Pentagon-Offers-Partners-L...